The Current State of Layer 1

Ethereum's shortcomings have led to high competition from new L1 players in the space.

Disclaimer: Any information posted on Polkastarter’s social media accounts shall not be considered personal investment advice or be construed as an express or implied promise, guarantee, or implication by Polkastarter that clients will profit from the strategies or that losses in connection therewith can or will be limited.

Author: @dariuskohsg

Editors: @glndlc, @_WaterAmi

In this new research report, we have gathered the latest developments in the Layer 1 landscape so you can power up your research and anticipate market trends. You will find:

- Criteria to evaluate different monolithic blockchains

- A comparison of current players in the space

- Key L1 players and their competitive advantages over Ethereum

Before we dive in, it’s important to note that Layer 1 protocols are essentially base networks. That includes Bitcoin, Ethereum, BSC, Solana, Avalanche, and Near, among others. Layer 2s, which we will cover in a different article, is the scaling efforts built on top of these base networks. Examples of L2s are Lightning Network to Bitcoin and rollups to Ethereum.

The Layer 1 sector has a market cap of at least $215B, with Ethereum at around $200B alone and its main frontrunner, Solana, with $12B. The shortcomings of Ethereum, however, have led to the emergence of other L1s and the space becoming highly competitive over the last few years.

Evaluating Key L1 Players

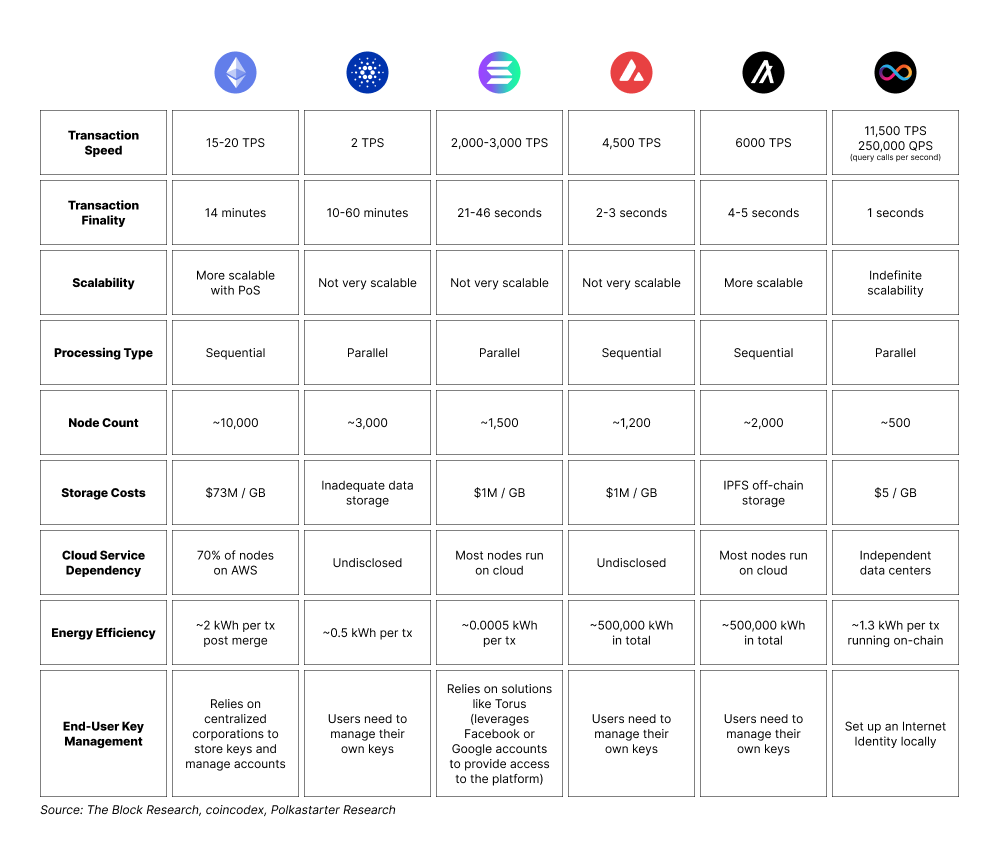

How do these networks compare to Ethereum, though? What are Ethereum's shortcomings in the first place? Some of them include low TPS, sequential processing, high storage costs, and high cloud service dependency, among others. Let's review the aspects that will set these networks apart from each other and will help us evaluate them individually.

- Transaction Speed: How fast can a network process transactions? This key metric includes transactions per second (TPS) and block finality. TPS is essentially how many transactions can be processed successfully in a second, while block finality represents the duration between a block's initiation and its final, irreversible settlement on the ledger.

- Scalability: Blockchains are scalable when they support high transaction throughput and can grow to accommodate new users. In a scalable blockchain, network traffic doesn't significantly hamper overall performance.

- Node Count and Cloud Service Dependency: The number of blockchain nodes and their distribution is a robust indicator of a network's relative decentralization. The cost of storing smart contract data on-chain can be exorbitantly high, so most dApps typically rely on centralized servers and cloud providers such as AWS, Google Cloud, Microsoft Azure, and Alibaba Cloud.

- Energy Efficiency: Blockchain technology must reduce its carbon footprint to become sustainable. Energy-intensive Proof-of-Work consensus adversely impacts the climate as miners need enormous energy to power their equipment.

- Inter-Chain Bridges: Blockchain bridges support the transfer of data packets and digital assets between two separate chains.

- End-User Key Management: Blockchain adoption is still slow because users are wary of security key management that requires safe storage options. Web2 applications like Facebook and Google rely on easy single-sign-on (SSO) solutions. In most Web3 dApps, users have to use complex private keys and set up a crypto wallet to access the platforms.

- Blockchain Performance: Ultimately, the best performing blockchain is one that offers the most value for developers and users across a variety of use cases — namely, things like DeFi, NFTs, games, and various dApps. What does the protocol offer in terms of developer and user experience? What about its ecosystem and relative capabilities?

See a comparison of L1 players taking the above into account:

Close up: Sequential vs. Parallel Processing

This bottleneck of Ethereum is worth zooming in on. Ethereum's EVM processes transactions sequentially, and it cannot do so in parallel. Let's see what this means and what the alternatives are.

Sequential processing means that a blockchain is processing one transaction after the other in a logical order. This occurs, for example, when user A sends tokens to B and B sends them to C. In other words, it would take a much longer time for each transaction to be verified via thousands of nodes. Moreover, regardless of being L1 or L2, an EVM can only process in sequential order. Arbitrum, Optimism, ZK-Sync and Starkware all have inherited this problem.

Parallel processing, on the other hand, consists of user A sending different tokens to B and C simultaneously. Blockchains can process these transactions in parallel because they have no conflicts with each other. Solana is an example of a parallel processing blockchain. This makes higher TPS attainable for a blockchain without relying on high performance computing or mathematically driven solutions like zero-knowledge.

The only way to tackle this inability to process transactions parallely is to redesign a virtual machine (VM). An ideal rollup could theoretically be a ZK-rollup with a Solana-like architecture built on the base layer of Ethereum. This means it would inherit the security and stability of Ethereum but also have Solana's TPS and parallel processing. Unfortunately, this type of offering doesn't exist as of yet.

The key direction for L1 remains to perform parallel processing and modularize its public blockchain.

What's new in the parallel processing world?

There are two highly anticipated L1s: Aptos, valued at USD 3B, and Sui, valued at USD 2B. Both aim at solving Solana's frequent downtimes and Ethereum's inability to perform parallel processing and achieve much higher scaling without sharding.

What's there to know about them?

- They scale by decoupling the codependent execution and consensus layers via a parallel execution engine that eventually synchronizes

- Both were created by the Diem team

- Able to process 100,000+ TPS and perform parallel processing

- Adopted Move as their smart contract coding language, which has imposed higher security and mechanisms to safeguard against human errors and increase smart contracts’ security by avoiding vulnerabilities

- They aim to optimize scalability by maximizing network capacity, similar to Solana

The bottleneck, however, would most likely be state growth in the ecosystem. To address this issue, Aptos prioritizes heterogeneous validators (constrained CPU and storage), whereas Sui plans to shard data storage efficiently and scale its resources horizontally. Another difference is that Aptos has a fast state synchronization and Account recovery technique and, on the other hand, Sui uses Object rather than Account as the base unit, and then introduces payment for state storage.

All in all, we have to admit that there is some innovation in the space, but still to a lesser degree than Solana. Although it faces downtime, Solana's transmission consensus is widely recognized as a breakthrough in L1 and it has also achieved the highest possible TPS in the realm of a monolithic chain.

Close up: Monolithic vs. Modular blockchains

All of the above networks are monolithic blockchains: those that handle their duties in the same layer, including consensus, security, data availability and transaction execution. Modular blockchains, on the other hand, intend to overcome these issues by focusing on specific tasks and offloading the rest to other layers.

Strictly speaking, Polkadot and Ethereum 2.0 are to be considered modular blockchains, but Celestia has split the two-layer structure into three layers, capturing the essence of "modularity" more effectively. With its separate Data Availability (DA) layer, its potential is limitless.

Different implementation and settlement layers, as well as the various permutations and combinations of these layers, can lead to the creation of new innovations. The most noteworthy being Sovereign Rollups. They are unique because they are independent of any base layer. They can push upgrades and hard forks without permission from Celestia's consensus. Since Celestia doesn't have smart contracts, proofs are instead verified by rollup nodes.

According to Celestia, the Layer 0 of its final form is the Social Consensus. Ethereum Rollup, although safe, is actually the expansion chain of Ethereum, which loses its sovereignty and is more like a state in the United States. If you want to create your own country, adjust it flexibly and fork it at any time, you would need to have your own Sovereign Rollup. One of such Sovereign Rollups is Celo.

As for whether this sovereign-focused Rollup or ETH’s security-focused Rollup will prevail or coexist in the long run, it's too hard to tell. We may only find out in another two years’ time.

Sidechains

Sidechains are independent blockchains with their own consensus mechanisms and a two-way peg (or bridge) that connects them to the main network, allowing for assets to be exchanged between them.

Many base networks have made it easier to launch sidechains on their main chain. Apart from Cosmos, Polkadot, Avalanche, BSC and Polygon have released similar offerings: Binance Application Sidechain and Supernet respectively. The sidechain infrastructure has advanced rapidly and far exceeded market demands.

All in all, some interesting innovations have been made in the Layer 1 space. It is also true that they will take some time before they achieve mass adoption. After all, some of these technologies are in very early stages and could be considered experiments. Only real life use will put them to the test. Which ones do you think will succeed?

About Polkastarter

Polkastarter is the leading decentralized fundraising platform enabling crypto’s most innovative projects to kick start their journey and grow their communities. Polkastarter allows its users to make research-based decisions to participate in high-potential IDOs, NFT sales, and Gaming projects.

Polkastarter aims to be a multi-chain platform and currently, users can participate in IDOs and NFT sales on Ethereum, BNB Chain, Polygon, Celo, and Avalanche, with many more to come.

Website | Twitter | Discord | Telegram | Instagram | Newsletter | YouTube | Poolside

Polkastarter Blog - Latest Polkastarter News & Updates Newsletter

Join the newsletter to receive the latest updates in your inbox.