Liquidity Staking Derivatives & The Shanghai Upgrade Aftermath

A quick look at the next narrative: LSDs for ETH

Are you curious about the latest trend in the crypto world? Look no further than LSDs, or "liquid staking derivatives," which have been gaining popularity in anticipation of Ethereum's upcoming Shanghai network upgrade.

In this article, we will revisit some of the significant improvements and introduce some key Liquidity Staking Derivatives (LSDs) concepts such as:

- What are LSDs in simple terms

- LSDs' competition

- How will the upgrade impact stakers

What a re Liquid Staking Derivatives (LSDs)?

After the Merge, the consensus mechanism changed to PoS. There are no more miners, and block mining rewards are harvested by the validators instead. Those who want to help validate the Ethereum network while simultaneously earning rewards need to stake 32ETH, which is locked and untradeable.

Enter Liquid Staking Derivatives (LSDs).

Liquid staking protocols have modelled their business around the concept to overcome this hurdle. By pooling users’ ETH and staking it on their behalf, they issue Liquid Staking Derivatives (LSDs) that represent users’ stakes in the pool and allow them to earn staking rewards with improved liquidity while still outsourcing the burdensome node management responsibilities.

While Ethereum users have been able to participate in staking since the launch of the Beacon Chain in December 2020, we expect many new ETH holders to stake for the first time now for a variety of reasons.

First, Merge-specific risks are now gone, as the network successfully completed the Merge and finalized its first checkpoint under proof-of-stake on September 15, 2022.

Second, staking yields have risen meaningfully as yields now include transaction priority fees and MEV. On-chain ETH staking yields are currently around 5% APY. Additionally, profitable participation in consensus no longer requires the economies of scale inherent to mining that previously barred many normal users.

Lastly, should Ethereum staking develop similar to other competing PoS networks such as Solana, Polkadot, or Avalanche, which have about 50-75% of their native assets staked, there is a vast opportunity for growth from the modest ~12% of ETH staked today.

Today's attractive ETH staking yields will likely incentivize much higher validator participation on the way down to an equilibrium level, where staking rewards per validate rise (fall) as the number of validators decreases (increases).

The value proposition of liquid staking is straightforward — it allows users to do all three of the following at once:

- Maintain custody of their collateral

- Earn a staking reward

- Increase capital efficiency through redeployment of their LSDs in other DeFi protocols

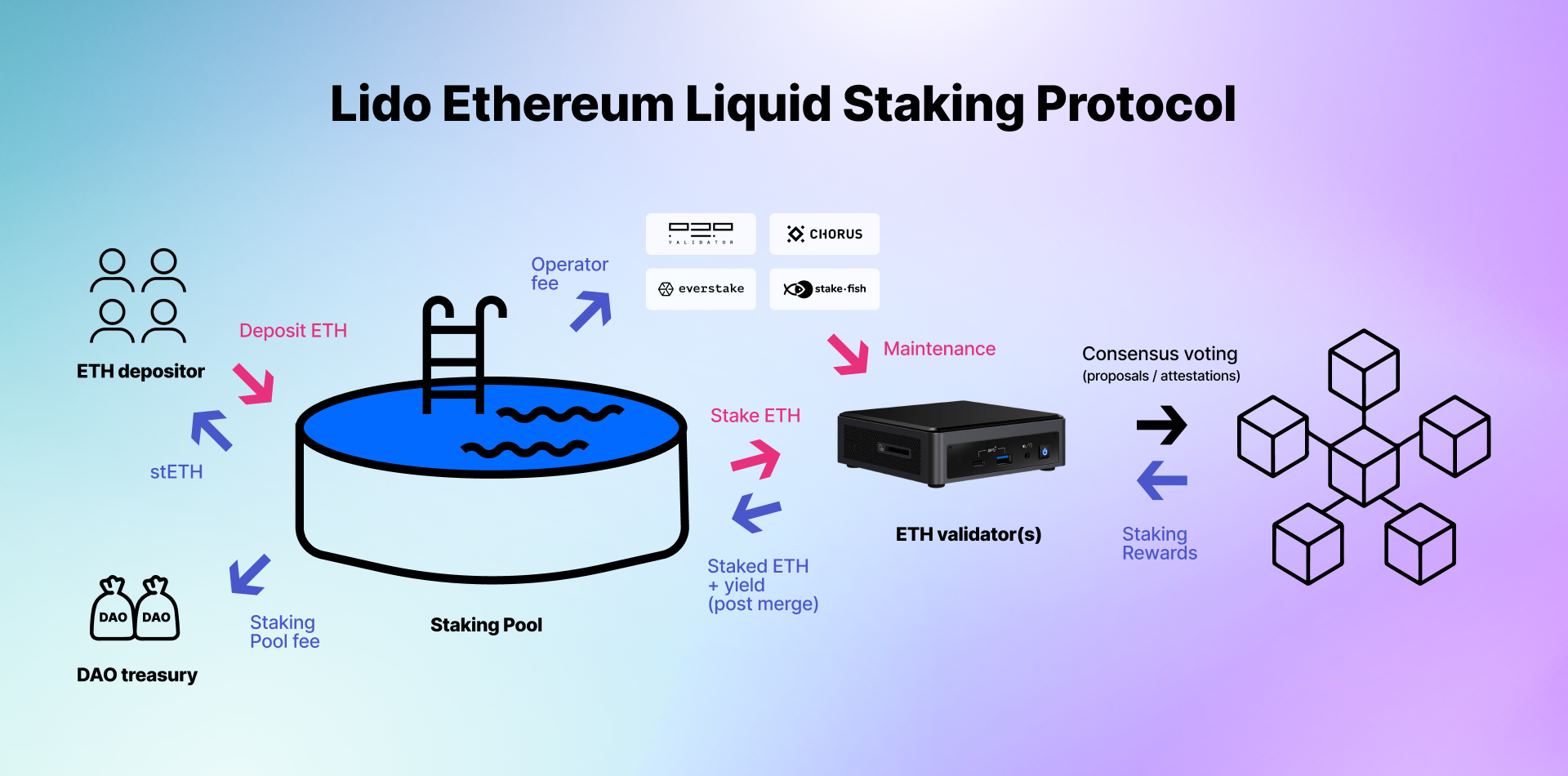

Let’s use the Lido Stake ETH, stETH, as an example of how LSDs work.

What is stETH?

Staked Ether (stETH) is a wrapped token of the underlying Ethereum that is "staked" or deposited to support blockchain operations. The token is minted on a decentralized finance protocol, Lido.

Here is a step by step process of how stETH (using LSD) works:

- You lock ETH on Lido Finance

- You receive a liquid staking token, stETH (1:1 ratio)

- Lido Finance then stakes ETH in the proof of stake process as a validator (to participate as a validator, a user must deposit 32 ETH into the deposit contract and run separate pieces of software: an execution client, a consensus client, and a validator)

- Lido handles things for you, and you can stake smaller amounts

- stETH is a rebaseable token, and it updates the balance of stETH holder, distributing the protocol’s total staking rewards and penalties

- When withdrawals are enabled on the Beacon Chain, stETH can be redeemed for unstaked ETH alongside its accrued rewards

LSDs competition

LSDs have been the talk of the town, with everyone wondering which ETH staking pool can yield the highest yields.

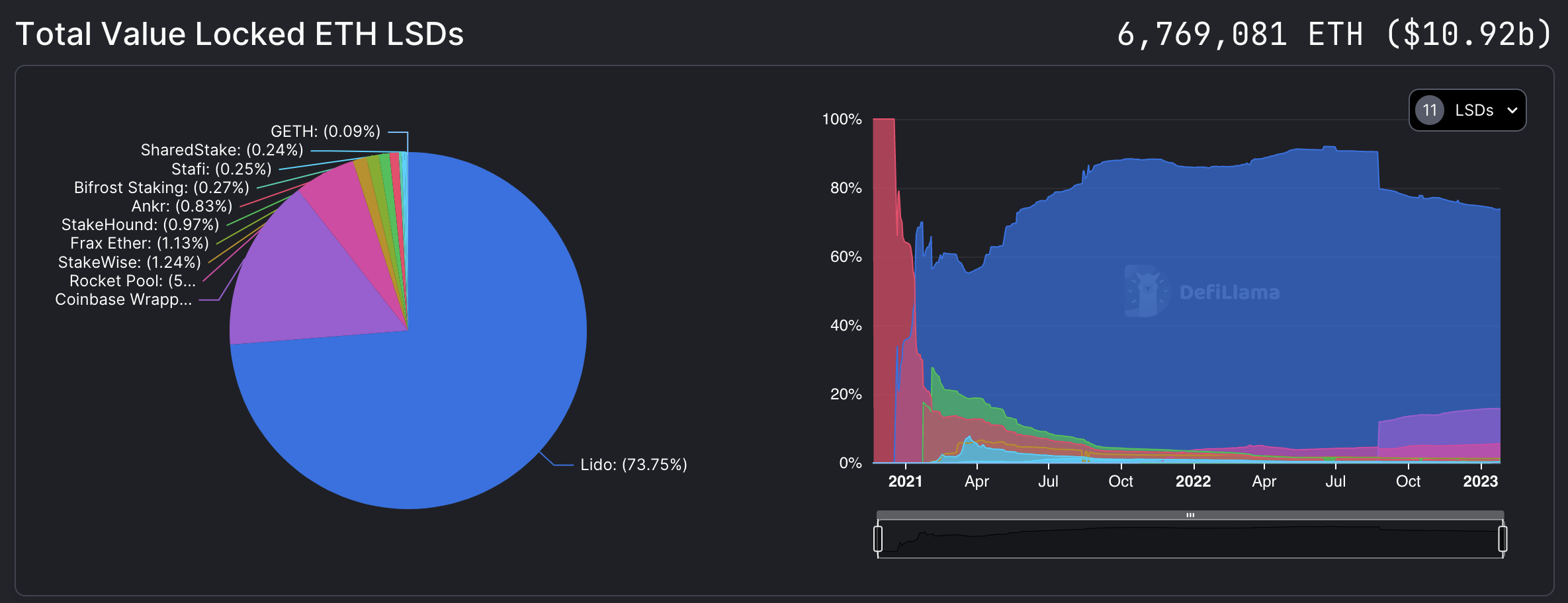

Lido’s stETH is the LSD market leader, with a whopping 73.75%TVL. On top of that, stETH are found in 1inch, Aave, Anchor, Curve, and more DEeFi protocols, which shows that the asset is favourable and adopted by both investors and DeFi users. However, monopolization of staking comes with risks, such as the pooled stake gains the ability to censor blocks, researchers suggested.

Other rising projects feature the likes of Rocket Pool. With almost $500M in TVL, Rocket Pool is the third-largest liquid staking entity, behind Lido and Coinbase. Rocket Pool’s powerful Oracle DAO is joining forces with Coinbase Ventures. The move aims to help Rocket Pool gain ground on its rival, Lido. To read more about Rocket Pool, here’s a great report by Messari.

What will the process for withdrawing staked ETH look like?

Validators wanting to withdraw their rewards or staked ETH will need to update their withdrawal credentials to the new "0x01" format. This is necessary because the Beacon Chain is being merged with the Ethereum network.

The network can only process a maximum of 16 withdrawals and 16 credential changes per block, which is produced every 12 seconds. This means it will take about 100 hours for all validator credentials to be updated.

Full withdrawals of a validator's staked ETH are subject to a limit and must have updated withdrawal credentials before processing. The network scans through validators by an index number and may be limited to 1,024 per block to prevent delays.

Withdrawals will be processed as system-level operations on Ethereum and will not have gas costs.

With the upcoming release of LSD protocols, the revenue generated from fees can finally be collected by the protocols. Kind reminder: many of these LSDs currently lack a system for distributing revenue to their governance token holder. As we move forward, it is important to keep an eye on the governance of your favorite LSDs for information on how the revenue will be utilized.

About Polkastarter

Polkastarter is the leading decentralized fundraising platform enabling crypto’s most innovative projects to kick-start their journey and grow their communities. Polkastarter allows its users to make research-based decisions to participate in high-potential IDOs, NFT sales, and Gaming projects.

Polkastarter aims to be a multi-chain platform. Currently, users can participate in IDOs and NFT sales on Ethereum, BNB Chain, Polygon, Celo, and Avalanche, with many more to come.

Website | Twitter | Discord | Telegram | Instagram | Newsletter | YouTube | Poolside

Polkastarter Blog - Latest Polkastarter News & Updates Newsletter

Join the newsletter to receive the latest updates in your inbox.